At Wolfgang Digital we’ve been analysing ongoing movements in e-commerce traffic and e-commerce revenue during the COVID-19 crisis.

We’ve been publishing online economy reports publicly, while also releasing deeper dives into the data privately for our clients’ eyes only. In this IoD members’ exclusive, we pull back the curtain and reveal both our public and our private key online economy findings. This article addresses online and multi-channel retailers, as well as the impact on travel and hotels.

Habits Matter

Pulitzer prize winning author Charles Duhigg, states in his book “The Power of Habit” that 40% of what we do every day is done on autopilot. It is a force of habit.

This matters to marketers. One of the reasons marketing exists is to exert an unconscious influence on the actions of the consumer. Every time a consumer hits the high street, reaches to a supermarket shelf, or unlocks their phone, a brand is seeking to influence the habit.

Habits matter to marketers.

Duhigg also states the “the difference between who you are and who you want to be, is what you do.”

These powerful words illustrate that habits matter to everybody.

In her 2009 study into habit formation, Dr Phillipa Lally found new habits take on average at least 66 days to stick.

We are now more than 126 days into the COVID crisis. Our ways of working, communicating, entertaining ourselves and shopping have been dramatically altered throughout this period. We’ve been forced to engage in many new activities during this time. The billion-dollar question for marketers around the world is “what new habits will stick?”

In a recent Battle Of The Internet Giants Wolfgang blogpost we responded to the “What Will The New Normal Look Like?” question by analysing the actions of the tech billionaires. In this article, I scrutinise cold hard commercial data to see how consumer shopping behaviour has changed since pre lockdown, paying particular attention to spending patterns since the shops re-opened in mid-June.

The Dataset

The first four weeks of our report fell in February and was before the COVID-19 crisis took hold; these weeks form our “base” period. Our dataset contained over €9 million online revenues in the retail and travel sectors combined in February, this accounts for approximately 5% of Ireland's online economy pre-COVID. The next 18 weeks are from March into June when the crisis escalated.

In this report we provide monthly figures from February to June 2020.

Retail: An Increase in Online Revenue

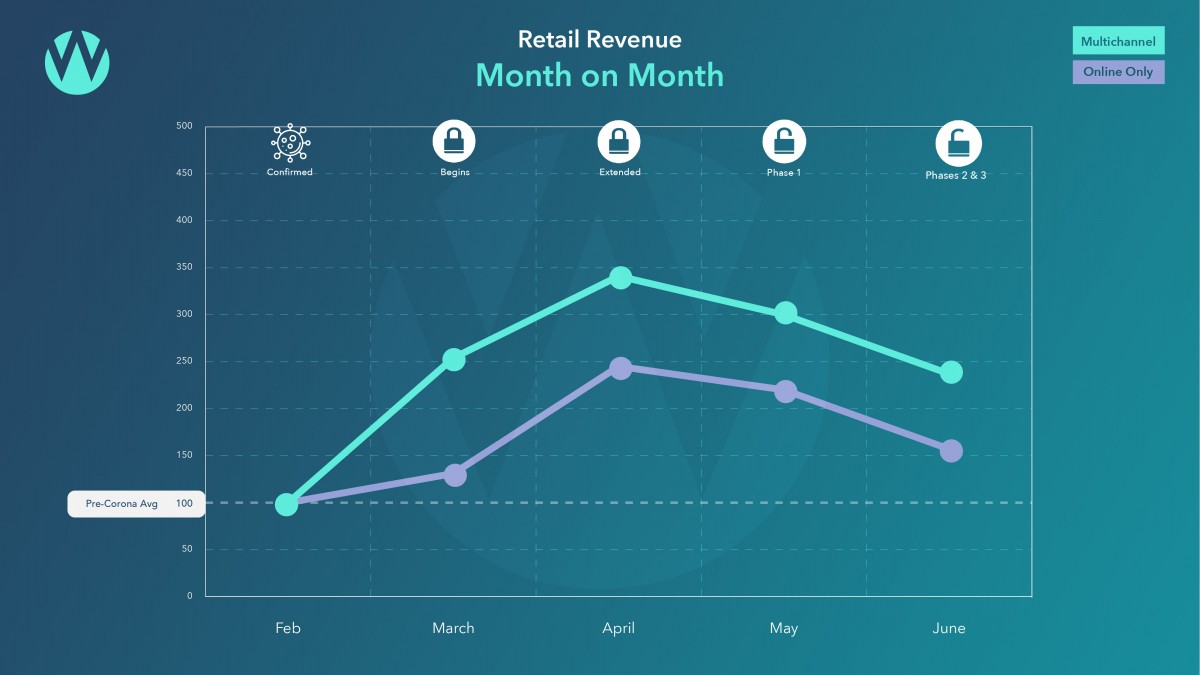

Retail Revenue - Month on Month

Looking across the four months we see online revenues have been more than double their pre-COVID average in every month during the crisis. Online revenues peaked in April at more than treble the pre-COVID levels.

June’s retail figure is still more than double the pre-COVID level at up 112%.

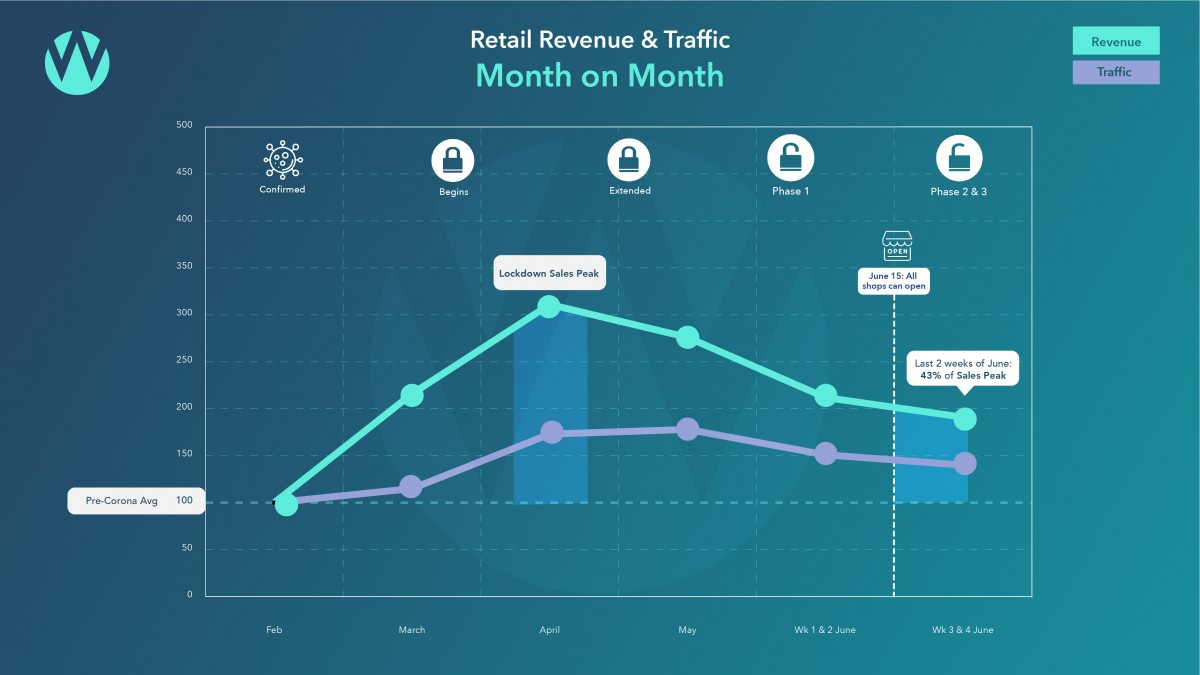

Retail Revenue & Traffic - Week on Week

For context, a reminder that shops started to reopen on the 8th and 15th June. If we focus on the period post 15th June, where all shops could open, online revenues are still up a staggering 91% on pre-COVID levels.

To give this 91% figure context, Wolfgang’s recent annual online economy studies 2016, 2017 & 2018 (unpublished) have shown an average of 21% revenue growth per annum for e-commerce retailers.

These stat reveals that retailers have experienced four years online revenue growth in four months!

COVID has propelled the Irish online economy into the year 2024

The consequence of this surge is that the online shop has become the flagship store. Many multichannel retailers are now seeing more revenue pass through their virtual till than through any of their high street tills.

This is the second shift in retailers’ understanding of their website’s value in quick succession. The website was once seen as “just another store”. The first shift was as a result of new reporting. The recent advent of research online purchase offline (ROPO) reporting from digital media duopoly Google and Facebook, meant retailers had visibility on the large proportion of in-store sales that started with a website visit. As a result, they began to view their website not as a “competitor” to their stores, but as the “gateway” to their stores. The second shift is as a result of the pandemic. As a consequence of COVID-induced lockdown, retailers are now seeing their website as their number one driver of revenue, as well as the gateway to all their other stores. The website has become the flagship store.

Retail Revenue & Traffic - Month on Month

Another question on business people’s minds is what proportion of the peak revenue will remain online? Remember Duhigg’s statement about 40% of your day is conducted on autopilot? In a curious parallel, 43% of the increased spend at peak lockdown in April is still being spent online since shops have reopened in June. For almost half of that new shopping activity, the power of habit has been established.

An illuminating example of changing habits is provided by Tesco. Tesco prioritised over 65s with their home delivery service. Pre-COVID, 3% of their deliveries went to over 65s. That figure has quadrupled to 14% of deliveries now going to over 65s. Many of these new online shoppers wouldn’t have intended to shop online before, but given the convenience of home delivery, they may rarely step foot in a store again.

One in five people in Ireland is over 65, this is probably Ireland’s wealthiest demographic. Now that the over 65s have formed the habit of buying groceries online, it is likely the habit will spread to other facets of their spending.

Multi-Channel Retailers

These are retailers who sell via a shop and online. This group of retailers has had a remarkably different COVID crisis than their online only counterparts.

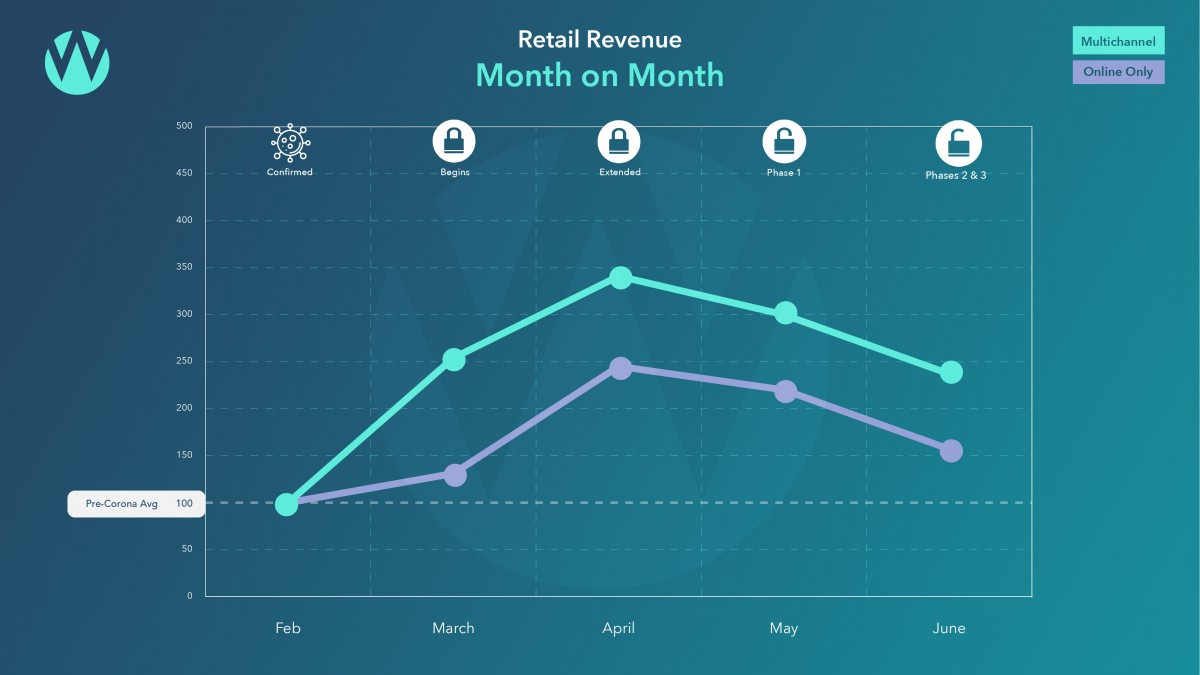

Retail Revenue - Month on Month

Multi-channel retailers’ June revenue was up 137% on the base period. With shops opened in mid-June, you might expect to see these figures fall dramatically as shoppers swarm back in-store. However, the majority of those new COVID online consumers have continued to shop online.

Retail Revenue - Week on Week

Since 15th June, revenue continues to be more than double, up 116%, on average on pre-COVID levels.

This illustrates that multi-channel customers have established the habit of shopping online. We’ve advice on how multichannel retailers can consolidate this habit in the next section.

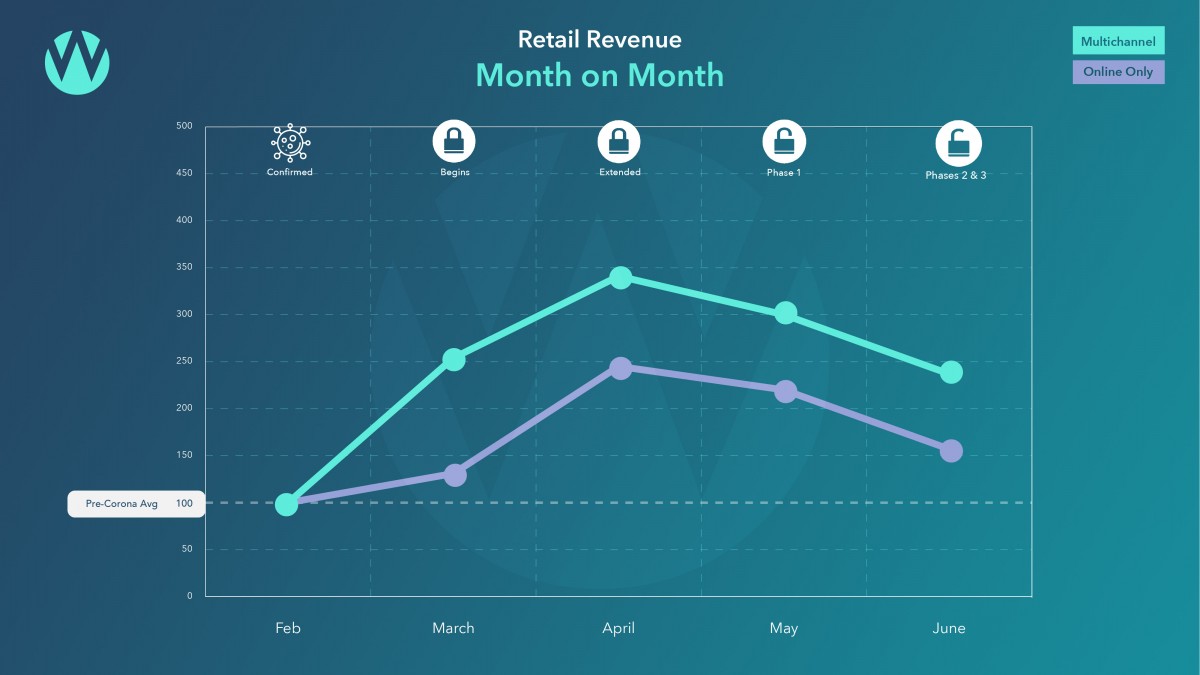

Online Only retailers (Wolfgang client only data)

Retail Revenue - Month on Month

Online only retailers have seen revenue fall from April’s high of up 145% to up 57% in June.

Online only retailers were slower to rise than their multichannel counterparts, and they appear to be falling faster.

Retail Revenue - Week on Week

In fact, in June they have trended down to as low as 35% up on pre-COVID levels.

The data suggests that the online only retailers benefit from “refugee shoppers” from the big brand multi-channels but have failed to convert those one-time shoppers into repeat customers.

To understand this phenomenon, it is important to understand that the multi channels tend to be bigger brands than the online only stores.

The multichannel retailers’ revenues peaked in the fourth week of March. At this time, they were struggling to fulfill orders, and some stopped taking orders temporarily. This led to a flux in spend move from their loyal customers to often lesser known online only retailers who saw their peak revenue later in April and in early May. Since shops re-opened in June, the online only retailers have seen revenue fall faster than their multi-channel counterparts.

So, what can all retailers do to transform that peak lockdown website traffic and revenue into habitual shoppers?

Duhigg describes a neurological loop at the core of every habit.

1. Cue

2. Routine

3. Reward

The sweet spots for changing habits are at cue and reward. From an advertising perspective there are smart things retailers can do to trigger a cue in an audience. All those extra site visitors and new customers are a valuable business asset. They can be used as audiences in both Facebook and Google. This means the next time one of your once off customers from lockdown goes to Google to search for a product you offer, or even to search for the brand of a competitor, with some sophisticated audience strategies you could be front and centre on the Google SERP encouraging them to come back and buy a second time, a third, and a fourth, consolidating their habit of shopping with your brand. You can reach these prospects in a similar fashion on Facebook, Instagram and YouTube. Over the years at Wolfgang, we've found audience-based cross-platform campaigns to be among the most high performing we've executed; half the awards on our wall have cross-channel audiences central to the strategy.

Travel

Travel continues to fester in the doldrums of decimated demand.

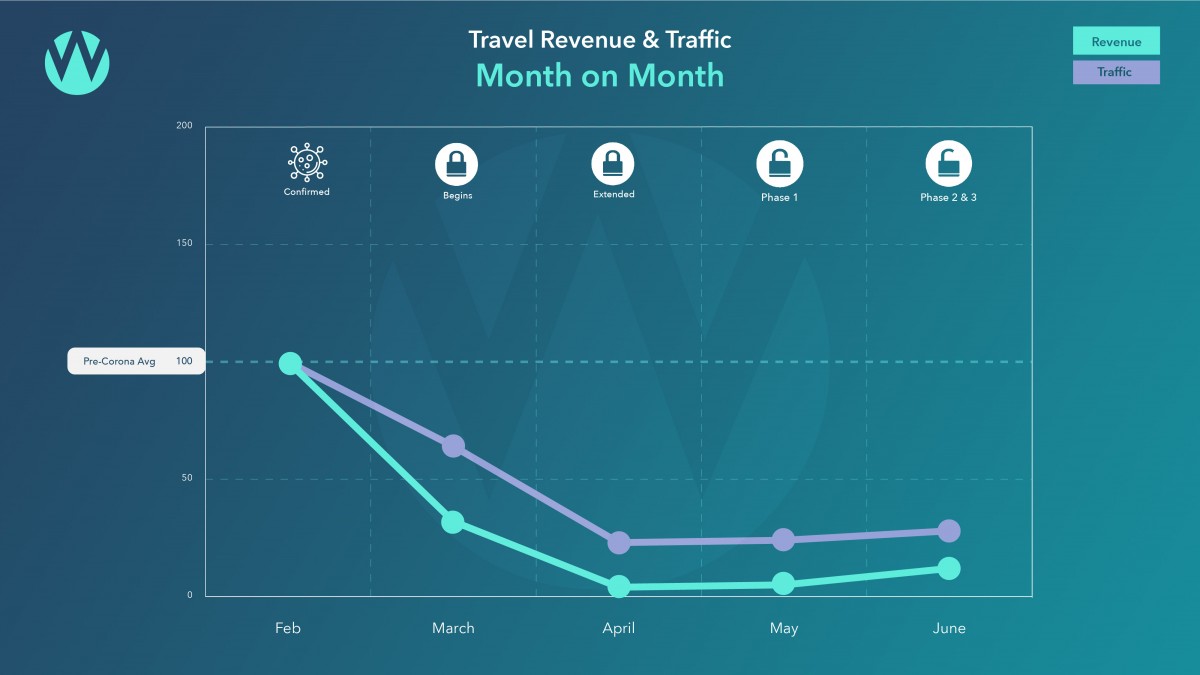

Travel Revenue & Traffic - Month on Month

While revenue has been increasing since April’s low of 4% of the base figure, the current figure of 12% of base for June is depressing.

In a recent IoD article, Tourism Ireland CEO Niall Gibbons highlights the fact that €5.8 billion was spent here last year by overseas visitors. It might surprise you to read, but according to the CSO Irish people actually spend more money travelling abroad, €6.4 billion on non-business international travel in 2018.

So, given our balance of trade deficit when it comes to travel, no international travel could have a net positive impact on the domestic Irish travel sector.

As a consequence of this sleeping giant of pent up domestic demand, we’d hoped for a spike in online sales as people booked staycations from 29th June when the country opened up for domestic travel, but this has not as yet been the case.

Consumers splashed the cash on home and garden items during the sunny lockdown. Given the medical advice not to travel internationally, combined with the calls to shop local, there may be swathes of people now planning on spending the summer holiday days in their gaff and spending their summer holiday budgets in their garden.

Hotels (Wolfgang client only data)

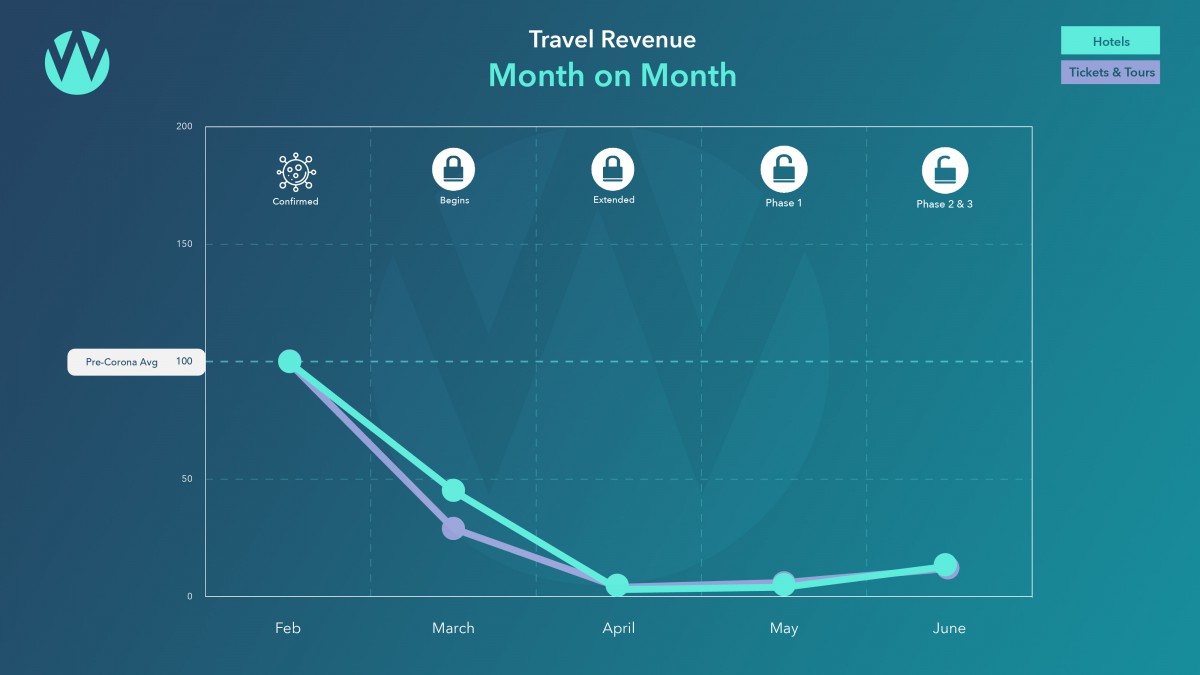

Travel Revenue - Month on Month

Hotels have increased from April’s low of 3% of base to 13% of base. An in-advance look at week two of the July figure shows that we are looking at an average of 23% of pre-COVID revenues.

Some hotel chains are seeing a remarkable difference between Dublin hotels and regional hotels. Dublin hotels are down more than half of revenue year on year. Some regional hotels are within 10% of last year’s figures. Furthermore, a significant chunk of regional hotels are actually up year on year.

Caveat: we are only looking at website bookings and have no visibility on Online Travel Agents’ bookings.

Conclusion

While it is still early to forecast exactly where the online economy will land post COVID-19, looking back to the consequences of SARS gives a clear indication of its trajectory.

The 2002-2004 SARS crisis accelerated China to their current position as the most advanced online economy in the world, with 36% eCommerce penetration.

This historic evidence coupled with our finding that at this point the COVID-19 crisis has accelerated the online economy by four years in four months means there’s never been a better time for business leaders to cement the habit of keeping up to date with the digital landscape.