The outbreak of COVID-19 presents a once in a century global public health crisis. The necessary precautionary health measures taken by both the Irish and international governments to restrict the movement of people will undoubtedly have had adverse implications for the economy and the housing market.

Projecting the total economic fallout and impact on the Irish housing market from the lockdown and the restrictive measures that will inevitably be in place immediately afterwards is incredibly challenging. With the crisis effectively pausing the Irish economy, however temporarily, it presents a shock to the economy unlike any experienced in living memory.

Scale of the Crisis

Furthermore, the scale of the crisis is still unclear and remains dependent on the length of time restrictive measures are in place, both at home and abroad. Inevitably, though, the impact will be wide ranging, with price performance, transaction activity, and construction output all impacted in the short-term to a greater or lesser extent.

Prices held firm at the end of the first quarter, but there is some downside risk, while the economy and labour market adjusts. In terms of sales activity, early indications suggest some degree of a slowdown at the end of the first quarter, albeit minimal. This will become more apparent in quarter two data with the full extent of the lockdown physically restricting the sales process. An increase in rental stock in urban areas was also noted in the immediate weeks after lockdown.

Once normal economic service begins to resume, it is imperative that the Government implements policy measures designed at boosting activity. This is especially pertinent in the construction sector, given the housing crisis will have not eased but rather likely deteriorated further. Indeed, the 21,000 new homes built in 2019 represented an estimated shortfall in the region of 12,500 to 18,500, with this shortfall likely to expand further again this year given reduced output levels

Akin to the economy, COVID-19 presents an unprecedented shock to the Irish residential market. In the run-up to the pandemic, the market witnessed a promising opening quarter with second-hand house prices stable at 0.1%, a positive outcome following six months of price deflation. However, the opportunity for this bounce to gain a foothold was delayed by the onset of the COVID-19 health pandemic, which has thrust the residential market into unknown territory.

Previous Shocks to the Market

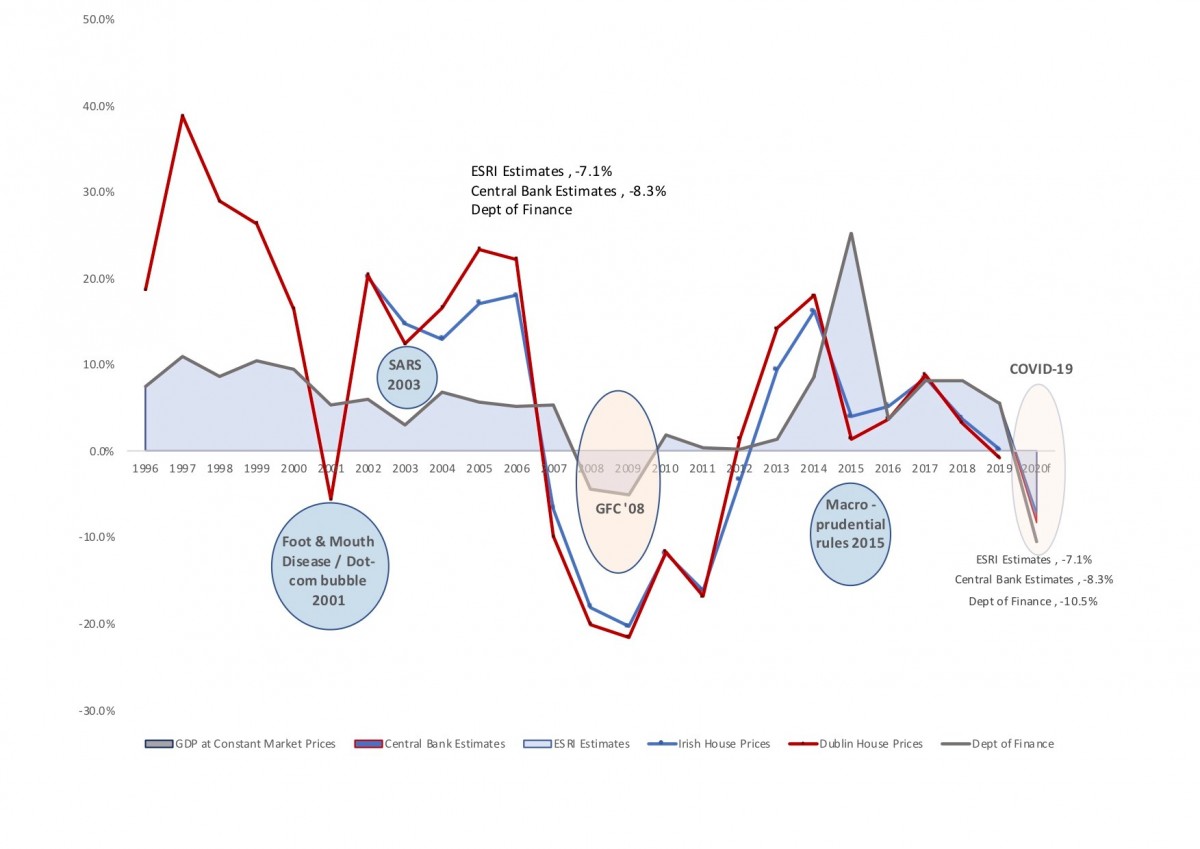

The following graph* depicts previous shocks to the economy, such as Foot and Mouth disease and SARS, and the resultant impact on mainstream house prices. Unlike COVID-19, these shocks were not necessarily in isolation and other factors were at play. COVID-19, as an economic shock, is unprecedented in both scale and nature.

GDP & Second-Hand Prices, Dublin and All Ireland, 1996-2019

Source: Sherry FitzGerald Research/CSO

Source: Sherry FitzGerald Research/CSO

True Impact of COVID-19

Thus far, there has been little data released on key residential related indicators to judge the true impact of COVID-19 on the residential market. As such, projecting the future price performance is incredibly challenging. House prices could soften in the short-term. However, the precise level of this contraction is highly uncertain, given the many unknowns surrounding the future path of the virus.

At this juncture, progress has been made in suppressing the spread of the virus, but the lockdown measures remain largely in place until at least the middle of May. If the economy reopens relatively quickly after this, and the structural damage to the economy is limited, the contraction in values could be short lived.

Favourable policy actions by the Government to date, such as a period of moratorium on mortgage payments, will have helped shield households and reduce the risk of mortgage defaults, which in the most recent housing crisis was a catalyst for house price depreciation. In addition, the introduction of a series of income support measures, such as the COVID-19 Income Support Scheme and the COVID-19 Pandemic Unemployment Payment of €350 per week, will have helped maintain income streams and pent up demand in the meantime, facilitating a swifter recovery in house values.

That said, there are downside risks, the major one being the unknown trajectory of the virus and a worst-case scenario of a second outbreak. Other notable downside risks include a delay in the recovery of the economies of our key trading partners. Ireland as a small open economy is heavily reliant on international trade and therefore slowdowns in international economies do have an impact on Ireland’s economy. In the event that the virus persists, resulting in a prolonged period of lockdown measures and economic disruption, we would expect a more protracted impact on prices.

Turning to transactions, early indicators suggest some slowdown in sales at the end of March, in line with the implementation of social restrictions, however they were not particularly significant. A reduction in sales activity will inevitably become more pronounced as quarter two progresses.

Again, the severity of this will be dependent on the economic impact of the crisis. However, some disruption is already evident in lead indicators. Second-hand home listings were down 40% nationally in March year-on-year, with further decreases inevitable in the coming months. This will impact the sales pipeline for the latter part of the year.

As there are so many unknowns as to the timing and nature of the loosening of lockdown measures, it is difficult to forecast with any accuracy the impact that COVID-19 will have on the overall volumes of activity. However, taking into consideration what is known at the time of writing, there is a strong possibility that overall sales in 2020 will be down by a minimum of 25% in the full calendar year.

The Housing Market Outlook

The outbreak of COVID-19 and the accompanying lockdown have prompted a set of circumstances that could not have been foreseen even a few short weeks ago. The housing market, like all other markets, has been directly impacted by the onset of COVID -19 and the accompanying lockdown. Akin to previous sharp shocks to the economy, we expect an associated contraction in all transaction activity during the coming weeks.

The full impact is, as yet, undetermined and will undoubtedly be a function of not only the length of the period in lockdown but also the medium-term impact on the labour market. As with previous sharp contractions, we anticipate some supporting policy intervention to assist the market recovery. This will be essential to underpin consumer confidence and support a renewal in transaction and construction activity in the recovery period.

Although in many ways we are in uncharted waters, there are some historical and international reference points which suggest that the market will reactivate, albeit on a reduced level, once the economy reopens.

What is known, is that many of the issues that beset the market prior to these events will not have disappeared. In fact, the housing crisis will be exacerbated given the contraction in construction activity. As such, the Government must put in place every policy measure feasible to ensure the sector returns to pre-crisis activity levels as quickly as possible.