Expert analysis from Mark Fegan, Financial Director, Bunzl.

Customers usually view a supplier’s profitability with suspicion. However it is the unprofitable or the marginally profitable supplier that they really should be suspicious of.

Suppliers who don’t manage profit margins:

- Cut corners to save costs and cost their customers more in the long run

- Have employees with low morale and high absenteeism

- Make promises they can’t keep

- Don’t invest in continued innovation and improvement ensuring their customers stay one step behind their competition

- Have a tendency to go bust and leave customers with a supply problem

You have a duty to all your stakeholders to be profitable.

This no doubt sounds like stating the obvious. You all certainly produce a profit and loss account every month and look at it in great detail. Surely this is managing profit?

The profit and loss account is a great monitoring tool, but does it really enable you to manage profit? Can it provide the answers to simple questions such as:

- Which customers are losing me money and what should I be doing about it?

- Are each of my suppliers profitable for me? Could I prove it to them the next time we are having price increase negotiations?

- Which areas of my market should I invest in to maximise profit?

- Are each of my sales teams pulling their weight?

- Do I really understand how my business makes profit?

- Does my pricing model reflect what it costs me to deliver each product?

We need to go beyond the routine profit and loss account to truly manage profit. At Bunzl, we used principles learned from Jonathan Byrnes’ book Islands of Profit and adapted them to what worked for us. I would recommend after each year end is complete getting your Finance team to analyse that year’s profitability in as low a level as they can manage. For me this is best done to line level, i.e. working out the profit for each product on each invoice sold over the past year. This makes for a very large file but allows the information to be sliced and diced in every way imaginable.

Two thoughts will occur to you:

- This sounds like a huge amount of work for little effort. It will just tell me what I already know in my gut.

- This sounds like ABC – the Activity Based Costing technique I vaguely remember from my university text books that usually descended into a group of nerd accountants arguing over the most accurate way to allocate the cost of a stamp.

It can be a lot of work if you let it, or you can be pragmatic in your approach.

Calculating Profitability

Let your Profit and Loss Account be your guide. Download your sales information into a spreadsheet and set up a column for each line of the profit and loss account across the top.

- Some information will be easily allocated e.g. sales value;

- Some will require a rule (keep it simple) e.g. spread the cost of the sales team equally across all the sales orders each team takes. Allocate based on an activity rather than generalisations like the sales value of each customer.

- Some will not be able to be allocated accurately without descending into stupidity, e.g. allocating the stationery costs. Leave these costs until the end. Work out the profit on each line using just the costs you can allocate directly. Then allocate the remaining costs prorata across this profit figure. This means that your final profit figure will be in the same proportion, i.e. the most profitable line will remaining the most profitable line; the second most profitable line will remain the second most profitable line etc.

This will leave you with a very large spreadsheet full of numbers. If you have a data warehouse system, upload it there to make it quicker and easier to analyse. You should budget twice as much time to analyse the information than you took to put it together.

Analysing Profitability

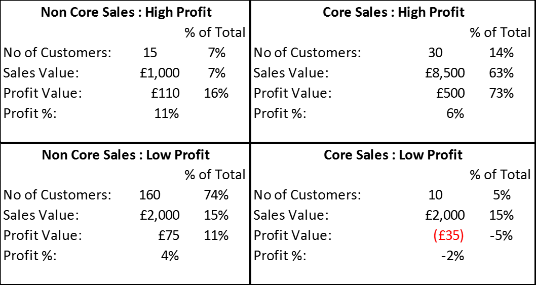

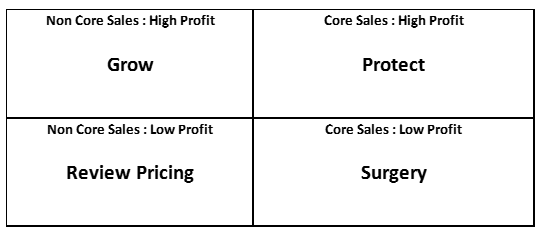

You can then start analysing your profitability. Take customers as an example. Filter your information so that you can see sales and profitability by customer. Put them in descending order of sales value and for the customers who make up the top 80% of your sales as ‘Core’ and the others as ‘Non-Core’. Then sort them in descending order of profitability and for customers who make up the top 80% of your profit as ‘High Profit’ and the others as ‘Low Profit’. This will allow you to put the information into a grid like the one below:

Your instinct will be to go straight to the low profit customers. However the most important customers are in the Core Sales / High Profit quadrant. These are the customers you must protect. Losing them will do your business enormous damage.

To action this information, again keep it pragmatic. Take the top 5 customers from each quadrant. Devise a strategy to deal with them, implement it and run the figures again to see the impact.

You will never be able to predict where the nuggets of profit improvement information are, but they are in there somewhere. Giving your Finance team the freedom to explore the information and the access to senior Sales and Operations staff to validate or challenge it will make you a stronger business because it will be built around a crystal clear understanding of who your customer is.

Good news for your customer.

Mark Fegan, Financial Director, Bunzl

The views expressed in the posts and comments of this blog do not necessarily reflect the views of the Institute of Directors in Ireland. They should be understood as the personal opinions of the author. The content of this blog is for information purposes only and the Institute of Directors in Ireland is not responsible for the accuracy of any of the information supplied.